Regulatory investments are increasingly important across the insurance sector. Regarding the distribution of insurance products, the European Insurance Distribution Directive, known as IDD and enacted on February 20, 2016, establishes the regulatory framework for insurance product conduct. This regulatory framework emphasizes the importance of providing advice that is fair, personalized, and well-documented. AI in nevertheless an opportunity to address these challenges in a mart way.

Fair and personalized advice

Specifically, Article 47 of the IDD stipulates that the analysis must be impartial and personalized, taking into account the client’s specific needs, the number of providers in the market, their market share, the number of relevant products offered by each, and the characteristics of these products.

Clear pre-contractual information

Article 48 defines the pre-contractual information that must be provided to the client to allow them to make an informed decision. This entails providing standardized information on non-life insurance products through an information document (IPID). Furthermore, it is pivotal for the broker to substantiate its proposal. He/she to explain the main features of the products and to dedicate the necessary resources and time to this end.

An increasingly complex regulatory framework

Regulatory requirements are becoming more complex to keep pace with the evolving landscape of insurance products, distribution channels, consumer needs, and technological tools. Regulatory authorities are intensifying their scrutiny of commercial practices, a trend that is expected to increase in the coming years.

Will AI simplify regulatory compliance?

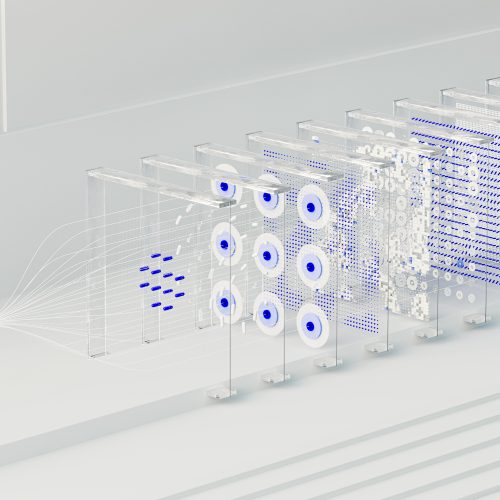

This increasingly complex regulatory framework can strain the resources of advisors and hinder their commercial productivity. The advent of AI increases the risk of fraud, which could lead to the adoption of new regulations. At Yakoota, we have developed an AI tool to help advisors comply with regulations in a straightforward manner. Our insurance contract rating and comparison tool is based on impartial facts and personalized data. Additionally, we have developed automated documentation to keep record of the advice given to clients. Our rating system allows you to focus the discussion with the client on the quality of the coverage using a simple and reliable indicator. For a demonstration of our tool, please contact us.